Kentucky Estimated Tax Vouchers 2024

Kentucky Estimated Tax Vouchers 2024. Kentucky dor announces individual income tax updates for 2024 tax year. You can print next year's estimated tax vouchers.

Tax type tax year (select) current 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000. Quarterly estimated tax payments for the 2024 tax year are due april 15, june 17, and sept.

Kentucky Dor Announces Individual Income Tax Updates For 2024 Tax Year.

For taxable years beginning before january 1, 2024, an electing entity is not required to make estimated income tax payments, and no estimated tax penalty will be.

How Do I Print Estimated Tax Vouchers For My 2024 Taxes?

The individual income tax rate for 2024 has also been established to be.

The Final Payment Is Due January 2025.

Images References :

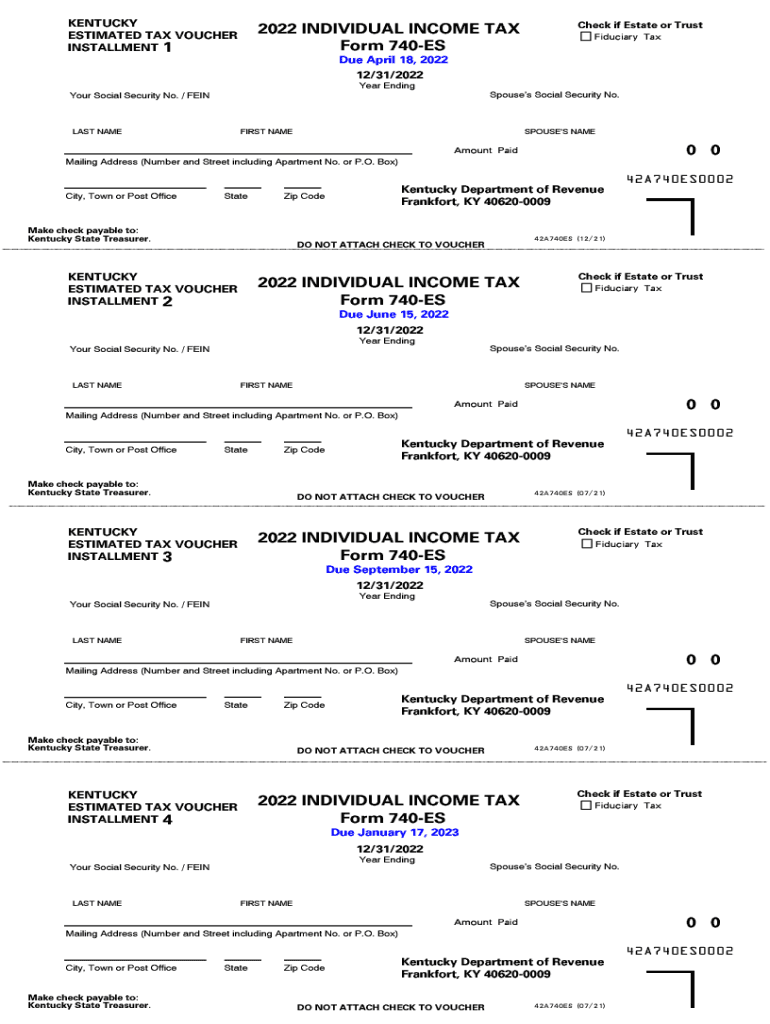

Source: www.signnow.com

Source: www.signnow.com

Ky 740 Es 20222024 Form Fill Out and Sign Printable PDF Template, Kentucky married (joint) filer standard deduction. Kentucky law lowers personal income tax rates for 2023 and 2024 and removes triggers for future rate cuts.

Source: www.dochub.com

Source: www.dochub.com

Kentucky tax type 005 Fill out & sign online DocHub, Single head of household married filing joint married filing separately. Please be aware that only ach payments can be accepted for these payments at this time.

Source: www.pdffiller.com

Source: www.pdffiller.com

Fillable Online 2023 Prepayment Voucher, Estimated Tax Fax Email Print, You can check the status of your kentucky current year refund at where's my refund? On february 17, 2023, kentucky governor andy beshear signed into.

Source: www.signnow.com

Source: www.signnow.com

Maryland Estimated Tax Vouchers 20222024 Form Fill Out and Sign, Kentucky dor announces individual income tax updates for 2024 tax year. The standard deduction for a single filer in kentucky for 2024 is $ 3,160.00.

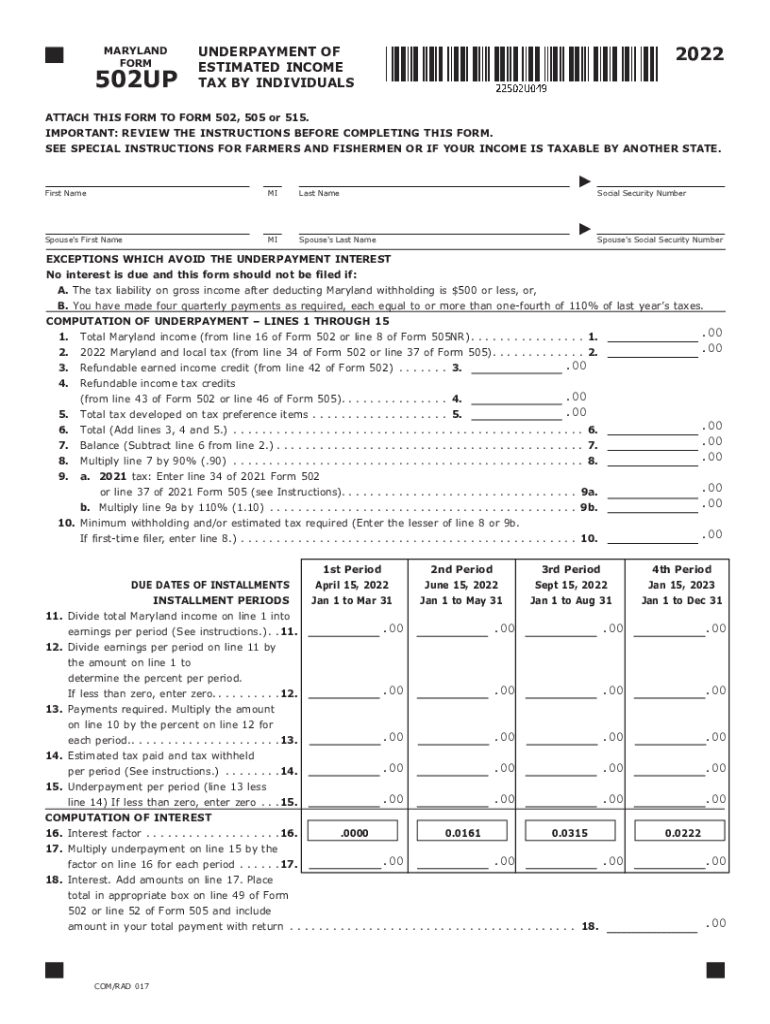

Source: www.dochub.com

Source: www.dochub.com

Minnesota estimated tax voucher Fill out & sign online DocHub, Solved•by turbotax•2439•updated 1 month ago. Kentucky dor announces individual income tax updates for 2024 tax year.

Source: www.dochub.com

Source: www.dochub.com

Oklahoma estimated tax Fill out & sign online DocHub, 1 announced that after adjusting for inflation, the standard. You can print next year's estimated tax vouchers.

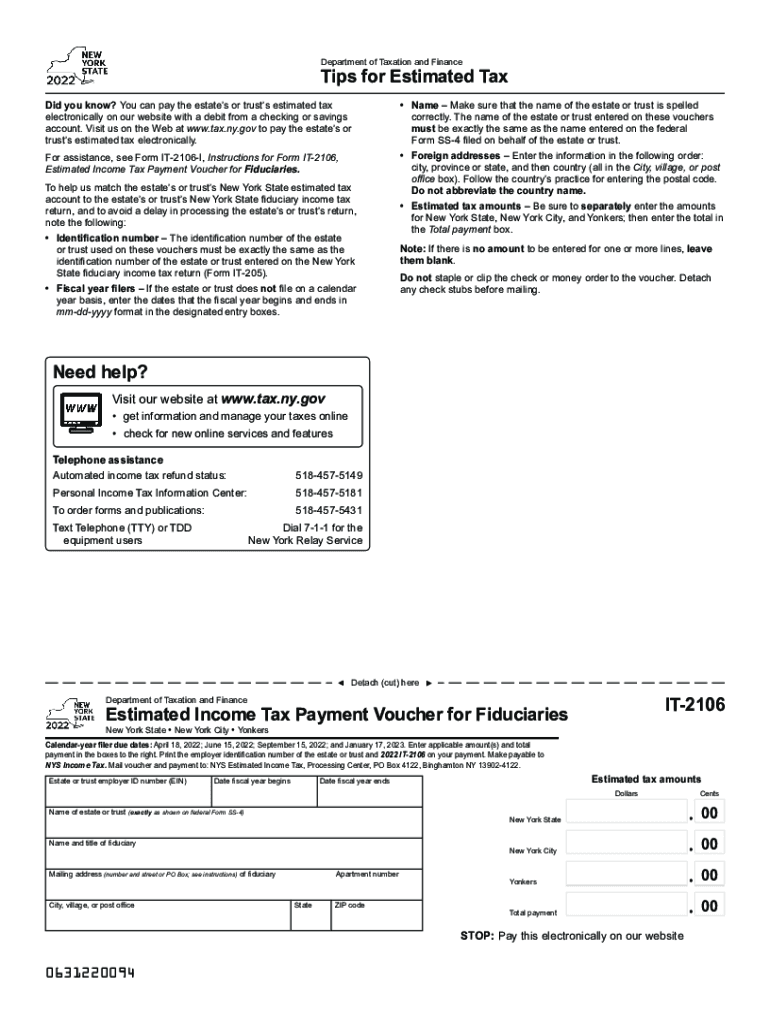

Source: www.signnow.com

Source: www.signnow.com

It 2106 20222024 Form Fill Out and Sign Printable PDF Template signNow, Kentucky dor announces individual income tax updates for 2024 tax year. Please note, the department of revenue.

Source: www.dochub.com

Source: www.dochub.com

Kentucky estimated tax payments Fill out & sign online DocHub, The final payment is due january 2025. Many kentuckians miss out on this tax credit.

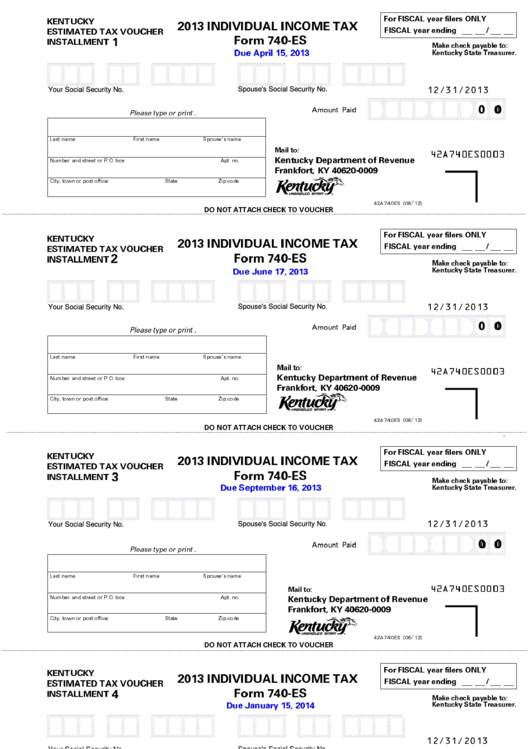

Source: www.formsbank.com

Source: www.formsbank.com

Fillable Form 740Es Individual Tax Kentucky Estimated Tax, Form 725 sch l, limited liability entity tax. Thanks to legislation supported by the kentucky chamber and passed by the general assembly, kentucky’s tax on personal income dropped from 4.5% to 4% at the.

Source: bench.co

Source: bench.co

What is IRS Form 1040ES? (Guide to Estimated Tax) Bench, The individual income tax rate for 2024 has also been established to be. Kentucky single filer tax tables.

1 Announced That After Adjusting For Inflation, The Standard.

Estimated individual income tax payments may now be scheduled through our electronic payment system.

This Amount Will Be Incorporated Into 2024 Tax Forms And Should Be Used For Tax Planning In The New Year.

For taxable years beginning before january 1, 2024, an electing entity is not required to make estimated income tax payments, and no estimated tax penalty will be.